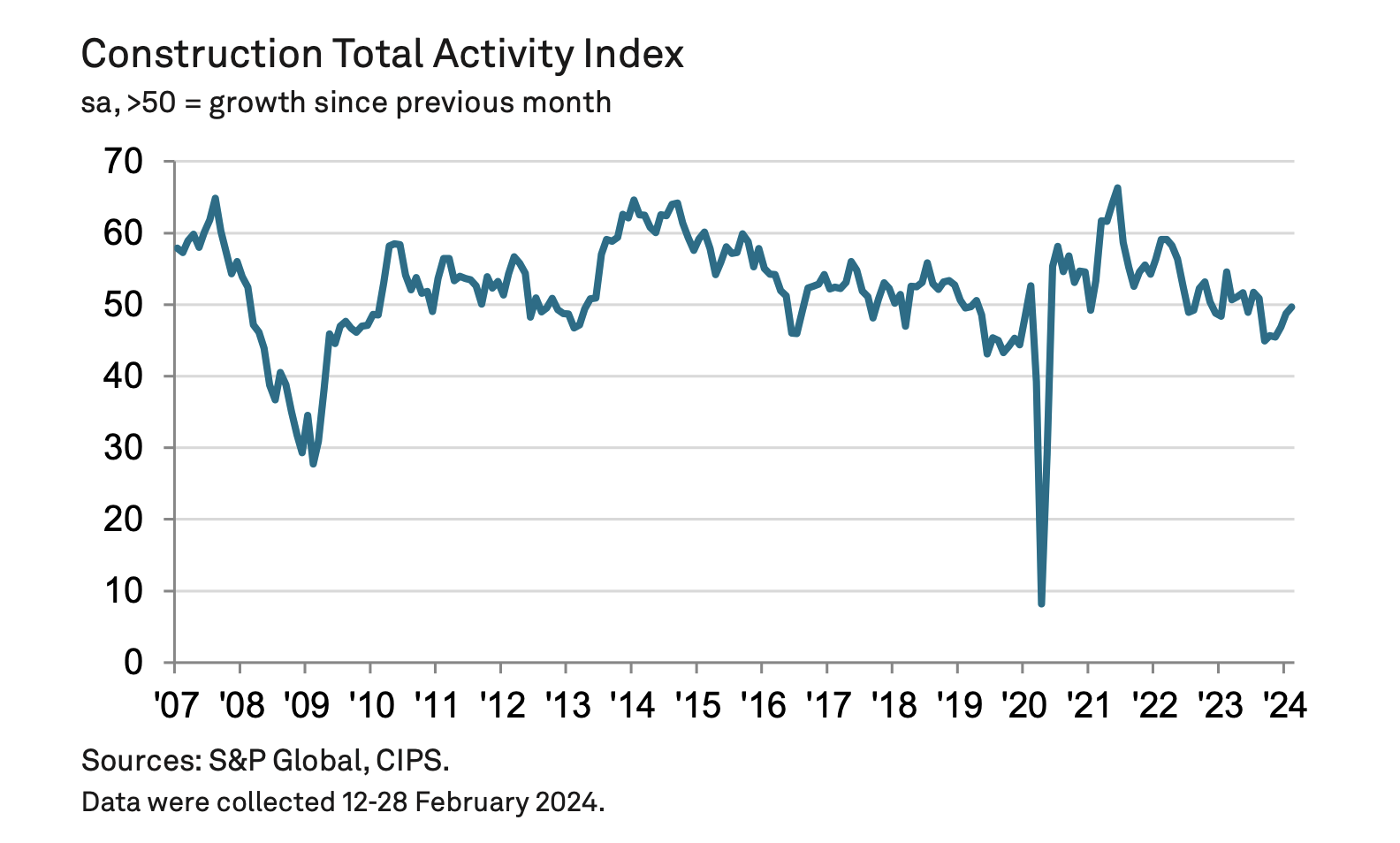

Construction buyers see fastest growth for 14 months

This post has already been read 395 times!

Anyone who works in construction over the last six months realises that inflation costs and other pressures have lead to jobs being postponed and clients looking to save money hopefully construction has turned the corner according to the latest buyer report.

The report All three main categories of construction activity saw a near-stabilisation of business activity in February. House building saw the biggest turnaround since January, with the respective index at 49.8, up from 44.2 and the highest level since November 2022. Survey respondents suggested that improving market conditions had gradually contributed to a stabilisation of residential construction work. In contrast, the commercial segment saw a more subdued performance than in January, with construction companies typically citing hesitancy among clients and constrained budget setting.

Key findings

- Total activity falls only fractionally as house

building stabilises - New work rises for first time since July 2023

- Business optimism remains most upbeat since

January 2022

Total new work increased marginally in February, thereby ending a six-month period of decline. This appeared to reflect a turnaround in tender opportunities and greater client confidence, especially in the house building segment.Employment was a weak spot in February, despite positive trends for order books and sales pipelines.

S&P Global Market Intelligence Economics Director Tim Moore, said:”A stabilisation in house building meant that UK construction output was virtually unchanged in February. This was the best performance for the construction sector since August 2023 and the forward-looking survey indicators provide encouragement that business conditions could improve in the coming months.

“Total new orders expanded for the first time since July 2023, which construction companies attributed to rising client confidence and signs of a turnaround in the

residential building segment. Meanwhile, the degree of optimism regarding year ahead business activity prospects was the strongest since the start of 2022, in

part due to looser financial conditions and expected interest rate cuts.”However, a protracted downturn in activity has

made construction companies cautious about their employment numbers. Staffing levels dropped for thethird time in the past four months and the latest round

of job shedding was the steepest since November 2020. Purchasing activity also decreased in February, but construction firms continued to cite supply side

challenges. Moreover, input costs increased for the second month running as strong wage pressures and renewed materials price inflation placed upward

pressure on operating expenses.”

Source https://www.pmi.spglobal.com/Public/Home/PressRelease/1604f755a8aa4888ae4b084caa5e883e