UK Construction buyers report return to growth

This post has already been read 131 times!

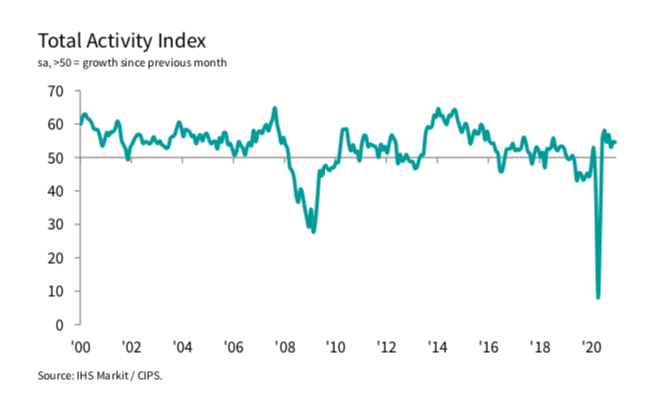

UK construction companies returned to a modest growth through September after two months of falling output despite the challenging conditions in the UK’s economy.

The outlook over the next two years is slowing but the modest rise in purchasing is due to previously delayed projects and new projects were relatively scarce due to inflation concerns and business confidence has dropped to its lowest levels for quite some time.

The highest performing sector house building grew in September with an (index of 52.9) this is a five month high.

Only magical increases for commercial work with an (index of 51.0), with engineering work activity (index of 49.6) falling for a third month in a row.

Many construction firms reported higher degrees of risk aversion and marked slower decision making among many clients due to inflation and money supply.

On the flip side supply shortages eased in September this is the best that has been seen since February 2020 and labour shortages also appeared to ease around 21% of those surveyed reported a rise in staffing levels, while only 8% signalled a decline.

Chief Economist at the Chartered Institute of Procurement & Supply, Dr John Glen commented saying that: “Developments in the UK economy have given the sector food for thought as supply chain managers reported softer levels of buying last month and the new orders index slipped to its lowest since May 2020.

“Though the headline index showed growth after two months in contraction, the devil lies in the detail pointing to lower customer confidence, a challenging UK economy and recession on the doorstep.

“Firstly, the rise in output has no sign of sustainable growth behind it as without new pipelines of work any gains will soon leak away. This was not lost on builders themselves who reported the lowest level of optimism since July 2020 about business opportunities in the next year.

“Secondly, the costs of doing business and the cost of living are still high and rising. More expensive energy and salary pressures to secure skilled staff have contributed

to additional inflation, though 21% of building companies in the sector were still hiring to maintain capacity for current projects.

“The housing sector remained the strongest performer in September although with interest rates rising and mortgage costs affecting affordability rates especially for first-time buyers, this will be an obstacle for house building to keep up the momentum as we approach 2023.”