Output dip in construction orders with materials delayed and jobs postponed

This post has already been read 229 times!

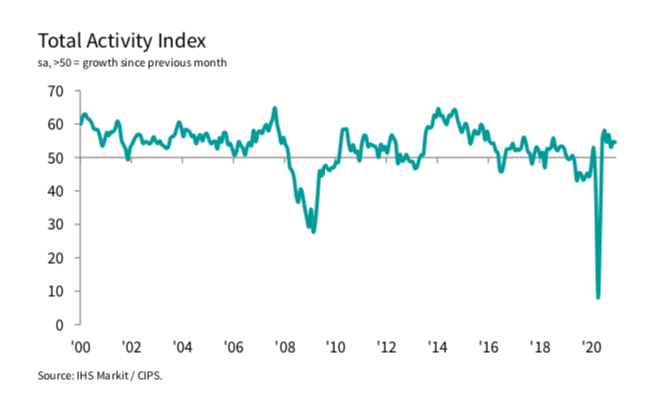

The pandemic is taking its tole with the IHS Markit/CIPS UK Construction Total Activity Index showing marked declines in construction purchases which signal a decline in overall construction output for the first time since May 2020 as it fell to 49.2 in January from 54.6 in December.

New order growth fell to its weakest since June 2020 with commercial and civil engineering falls not offset by a continued rise in housing.

As reported by nationaltrdesmen.co.uk construction companies and contractors continued to experience extreme cost pressures, driven by rising prices for plaster, steel and timber.

The overall rate of input price inflation accelerated to its highest for just over two-and-a-half years.

Economics Director Tim Moore, at IHS Markit, commend saying: “The construction sector ended a seven-month run of expansion in January as a renewed slide in commercial work dragged down overall output volumes.

“House building was the only major construction segment to register growth, but momentum slowed considerably in comparison to the second half of last year.

“Construction companies continued to report major delays with receiving imported products and materials from suppliers, with congestion at UK ports contributing to the sharpest lengthening of delivery times since May 2020.

“Adding to the squeeze on the construction sector, rising steel and timber costs led to the fastest rate of input price inflation for just over two-and-a-half years.

“The latest survey highlighted that construction companies have become more cautious about the business outlook.

“Output rebounded quickly after stoppages on site at the start of the pandemic, but hesitancy among clients in January and worries about near-term economic conditions resulted in a dip in growth expectations for the first time in six months.”

With group director at CIPS following on saying that, Duncan Brock, said: “Builders were feeling the pressure in January as new order growth across the sector fell sharply to the slowest expansion rate since June last year and the commercial sector particularly acted as a brake to sustained recovery.

“Clients hesitated to commit to new workflows because of concerns around the vitality of the UK economy which in turn brought cautious job hiring and obliterated the gains made in employment numbers in December. The residential sector had been relatively immune to the effects of lockdowns and pandemic disruptions but it too was beginning to show signs of weakness for the first time in over six months.

“Progress in the sector feels like two steps forward and one step back for builders, as the shortages and the longest delays in supply chains since May affected optimism and led to the sharpest rise in building costs since June 2018.”

Tim Moore, economics director at IHS Markit, said: “The construction sector ended a seven-month run of expansion in January as a renewed slide in commercial work dragged down overall output volumes. House building was the only major construction segment to register growth, but momentum slowed considerably in comparison to the second half of last year.

“Construction companies continued to report major delays with receiving imported products and materials from suppliers, with congestion at UK ports contributing to the sharpest lengthening of delivery times since May 2020. Adding to the squeeze on the construction sector, rising steel and timber costs led to the fastest rate of input price inflation for just over two-and-a-half years.”