Construction buyers see brighter days ahead

This post has already been read 739 times!

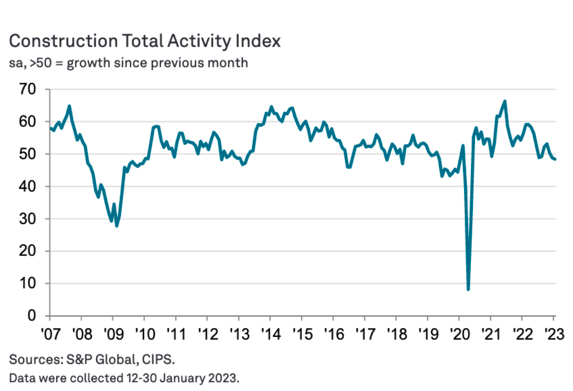

With new build taking the biggest hit according to he latest bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index but buyers insist that despite recession fears construction still looks ok.

With confidence returning to the market as its highest point during the last six months but new build dropped to 48.4 in January from 48.8 in December and was below the neutral 50.0 threshold for the second month running meaning that.

House building led the decline at 44.8 with the steepest rate of contraction in the sector since May 2020.

At present construction firms now are seeing sales pipelines improving and hopes of a turnaround to boost 2023 order books.

“Some firms cited optimism that confidence would eventually return to the housing market over the course of 2023, assisted by a stabilisation in borrowing costs.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “The wrecking ball of higher inflation and interest rates has knocked the UK’s residential building output to its weakest since May 2020 as stretched mortgage affordability impacted on the building of new homes.

“The other sectors also saw stagnation, so, it’s a construction conundrum, that builder optimism has risen to the highest for six months with the sector facing the second consecutive month of order books looking increasingly empty.

“This hopeful aspect could potentially be attributed to more enquiries filtering through to building companies which could develop into concrete orders in the coming months alongside the economy showing small, incremental improvements. Delivery times and material availability also improved which was a boost for firms working on ongoing projects.

“The continuing price pressures for energy and wages still remain a concern, along with the highest level of job shedding for two years and building skills remaining in short supply.

“Evidently, there are still roadblocks ahead, but we should have faith that the sector can see a path through for better outcomes in 2023 after languishing in

contraction in the last few months.”