Construction supply eases as industry booms

This post has already been read 220 times!

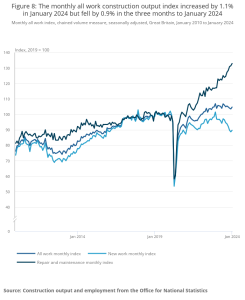

Its been a rocky road for the construction industry in terms of supply and cost of materials with the bellwether Markit/CIPS UK Construction PMI Total Activity Index showing supply chains improving in the short term.

The report contained good news even though growth slipped overall slightly to 54.3% from 55.55% in November still well ahead of the crucial 50 no-change threshold, the improved alignment between demand and supply helped to soften inflationary pressures at the end of 2021.

With purchasing activity increasing at the slowest pace for three months, while supplier lead times lengthened to the least marked extent since November 2020.

Where longer wait times were reported, this was mostly linked to international shipping delays and shortages of haulage drivers.

Group Director at the Chartered Institute of Procurement & Supply Duncan Brock, commented saying: “Though the overall index moved down slightly in December there was light at the end of the tunnel for builders in terms of the strongest order numbers since August, reduced pressure on business costs and some improved delivery times for essential materials.

“Residential building has powered on every month since June 2020 and was the best performing category in the last month of 2021.

“Commercial building struggled to gain a stronger footing in a weakened UK economy and civil engineering activity fell back into contraction.

“Though supply constraints were still hiking up prices, inflation was the lowest since March as materials production carried on apace reducing supply restrictions. It was shipping delays and haulage shortages that remained the significant gripes in the industry as over a third of supply chain managers faced longer wait times.

“Though this was an improvement on the previous month and the best since November 2020, it was still a factor affecting builders’ forecasts for 2022 as business optimism fell to the joint-lowest for almost a year.”