I have a LTD company and am a director can I claim 80% wages

This post has already been read 5062 times!

Nationaltradesmen.co.uk has been doing some digging regarding those with LTD companies and those who pay themselves though their companies, with many company directors thinking they are self employed.

We have had a lot of questions regarding the treatment of Limited company directors and if they are classed as self employed.

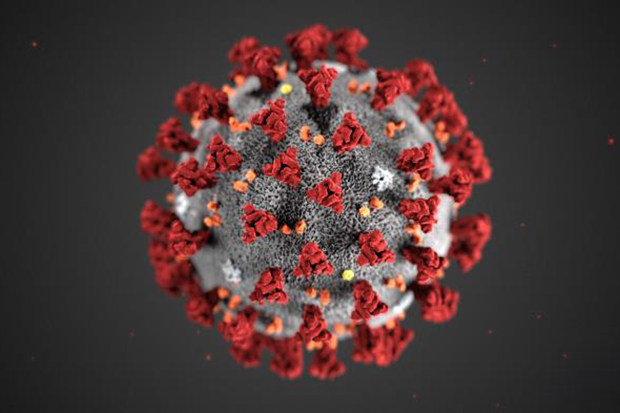

The Chancellor of the exchequer Rishi Sunak announced an unprecedented financial assistance scheme for self-employed workers affected by the Covid-19 crisis on Thursday 26 March 2020, it is unfortunate I have to inform you that limited company directors will not be covered by the “world-leading” package.

So what do we do now:-

- There are Business Interruption Loans. Please see attached.

- Check your insurance policies for Business interruption and income protection

- You can take mortgage payment holidays to help you personally

- Credit card and loan holidays are available

- Overdrafts can be increased

You can Furlough yourself as an employee of your business as long as you have a PAYE scheme in place. You can not work if you Furlough yourself.

I have attached the Information for employers and FQA.

Many small companies have directors that are taking a minimum salary of £715 per month you will be able to claim back 80% £572 per month.

If you are self employed and not a director of a company or your own company an example of what you can claim is below.

Example of how self-employed support scheme would work

Many self-employed construction workers carry business expenses of around 25% of turnover, so if tradesmen with a top-line income of £800/week spend £200 on expenses (travel, tools, insurances, accountancy etc) profit would be £600/week or £2,400/month. 80% of that would be £480/week or £1,920/month.

I hope you find this further information use full.

Please see the guidance notes which you can view and download.

CONVID-19 Furlough FQA for Employers

Please comment below if you require further information about your rights to claim.