Liquidations rise as banks call time on building contractors.

This post has already been read 2656 times!

Bloody banks at it again they love it don’t they you spend your life building up a business have a bit of trouble with a customer and they are on you, yet they go bust and we have to bail them out anyway here it is.

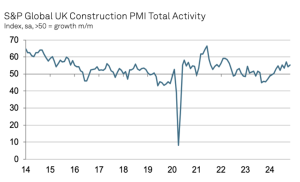

Shock figures from the Insolvency Service suggest compulsory liquidations rise as banks call time on building contractors.

Building firms now make up a quarter of all companies going bust this is not surprising but shows the banks lack of understanding of construction economics.

Official figures show a total of 868 construction firms were lost to the industry in the last quarter alone – meaning a total of 5,460 construction firms have gone out of business since January 2011.

Accountancy experts said banks are becoming less tolerant of struggling construction companies and forcing them out of business.

Alan Harris, director at specialist construction risk management firm, CR Management said: “The construction industry continues to jog along the rough and uneven road to recovery which now looks to be a long way off.

“As a consequence a number of main contractors that we are working with are looking again at their structures with a view to making further efficiency cuts in order to compete in the current and projected market and more will follow suit, although for some they will have left it too late

“Over the past quarter it has been noticeable that the companies becoming insolvent are of a larger size and hence are having a greater impact on the market.

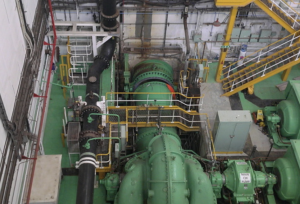

“In particular a number of mechanical and electrical contractors have ceased trading putting increasing pressure on main contractors to find replacement subcontractors who will guarantee the original work.

“This also puts increasing pressure on programme times leading to the possibility of projects falling behind and all of the cost ramifications this carries.”