Persimmon pre-tax profits rise to £99m.

This post has already been read 2045 times!

Big house builder’s like Bovis and Persimmon are bouncing back my theory is that they have squeezed contractors and suppliers even harder this is the only way they would see such good results.

The underlying headline seems great for them but from a workers point of view you have to wonder how they have done it in the worst recession since the 1930’s .

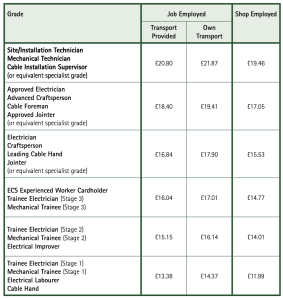

And trust me I have worked on sites like these, to do the second fix carpentry on a 4 bedroom house for £400 seems unreal. If you think in real terms that work is worth more like £4000 as a proportion of the house price.

Then they have the cheek to say oh you haven’t done that precisely enough what do they expect, of course they want the work carried out properly, but pay the men who are actually producing the work a decent wage the story is as follows.

The house builder’s return to high profitability was helped by a sharp rise in margins from 9% to 12.2% and completions up 6% to 4,712 new homes.

Revenue was also up 13% to £807m, driven also by a greater volume of family homes that lifted average selling prices by 7% to £171,206.

Nicholas Wrigley, chairman said: “These results reflect the early success of Persimmon’s new strategy to grow into a stronger, larger business whilst returning £1.9bn of surplus cash to shareholders.

“The future growth of Persimmon will continue to be based on the solid foundations of the good results achieved in the first half of 2012.”

Persimmon opened 65 new sites in the first half of the year and plans to open another 60 sites in the second half, maintaining the nationwide outlet network at around 380 sites.

Private sales weekly reservation rates were up 18% in the first six months. This dropped in the quieter summer selling period but was still 5% ahead of the same time last year.

Wrigley added: “We expect conditions in the housing market to remain challenging reflecting the wider issues within the economy.

“However, we anticipate continued firm underlying demand for new homes but this will remain constrained by the low level of mortgage availability.”